Last Updated on: December 15, 2025

The modern marketing and data landscape is complex. Collecting customer data is one thing, but effectively activating it across your tools to drive personalized experiences and measurable results is the real challenge. Two major players dominate the conversation around customer data infrastructure and activation: Segment and Hightouch. If you’re comparing Segment vs. Hightouch as CDPs or activation platforms, the real question is where your customer data lives today and how your teams need to use it.

Short answer: Segment is best when you need real-time event collection and marketing-led activation, while Hightouch is best when your data warehouse is the source of truth and activation is data-team driven.

What You’ll Learn

-

How Segment and Hightouch differ in event collection and data activation

-

When to use real-time CDP pipelines vs warehouse-first activation

-

How pricing models differ and where costs can surprise teams

-

Which teams (marketing vs data) each platform best supports

-

How to choose based on your business model and data maturity

Executive Summary

- Different Origins, Converging Paths: Segment started as event-first (easy data collection/routing), while Hightouch began as warehouse-first (activating data via R-ETL). Both now offer overlapping features (Segment has R-ETL, Hightouch has event collection), but their core strengths and architectures differ.

- Team Alignment & Ease of Use: Segment often offers a faster start for common marketing/product use cases with less initial data engineering lift. Hightouch provides deeper control favored by data teams comfortable with SQL/warehouse workflows but requires more technical setup.

- Reverse ETL (R-ETL) Trade-offs: Segment includes cost-effective R-ETL suitable for many standard needs. Hightouch offers best-in-class, highly configurable R-ETL ideal for complex, warehouse-native activation, requiring more resources but providing more power.

- Pricing Models & Risks: Segment’s primarily MTU-based pricing is simpler to forecast but risks cost spikes from traffic surges. Hightouch’s multi-variable (syncs, features, etc.) pricing can be cost-effective for warehouse-centric use but is harder to forecast and can escalate with high sync frequency/volume.

- Key Differentiators: Segment stands out with integrated tag management and a vast destination catalog. Hightouch differentiates with advanced features like AI Decisioning, MatchBoost (identity onboarding), and it supports some databases as sources which Segment does not.

- The Choice Depends on Context: The best platform depends on your primary goal (real-time events vs. warehouse activation), data maturity, team structure (Marketing-led vs. Data-led), critical integrations, and budget sensitivity to different cost models.

Quick Answer: When Should You Use Each Platform?

This breakdown helps teams searching for “Segment vs Hightouch” understand which tool aligns with their activation model, data maturity, and real-time needs.

Choose Segment if:

– You need real-time event collection

– Marketing teams need to self-manage tagging and tracking

– You want the broadest destination catalog or built-in tag management

Choose Hightouch if:

– Your warehouse is already the source of truth

– You need advanced reverse ETL, AI decisioning, or flexible modeling

– Data engineering owns orchestration and activation

Contents

What Is a Customer Data Platform (CDP) and Why Does It Matter?

Think about how scattered your customer information is. You have data from website visits, in-store purchases, mobile app activity, email opens, and support chats all sitting in different tools and offline files. A CDP’s job is to pull all of that information together in one place.

It starts by collecting data from all those sources, including from your data warehouses. Then, it stitches that information together and handles identity resolution across different identifiers and platforms. This connects a single person’s activity across different touchpoints, like linking their journey from your mobile app to your website, to create one complete customer profile.

Once you have these unified profiles, you can sort them into specific audiences based on their behavior. Finally, the CDP makes this organized data available to your other tools for marketing, advertising, or analytics. This helps you understand your customers on a deeper level and personalize their experiences.

For a deeper dive, you can check out our post on What Is a Customer Data Platform? or download our ebook on the topic: What is a CDP?.

Segment vs. Hightouch: How Each Platform Is Built and When It Matters

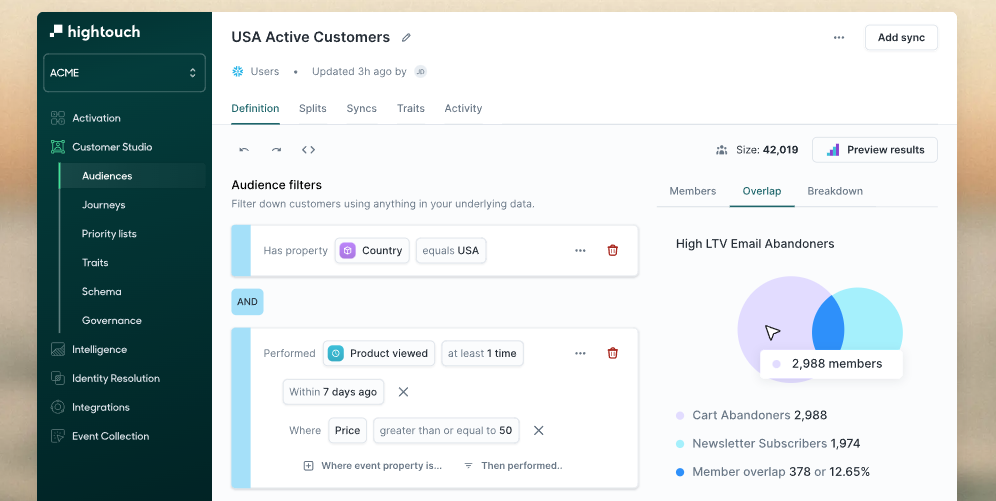

Segment got its start by making it incredibly easy to track what people were doing. It offered simple code snippets to capture every click on a website, every action in a mobile app, and even server activity. The main goal was to be the simplest way to get that stream of user behavior flowing into other tools. While that’s still at its core, Segment has grown to do more, now helping to stitch together all that activity into unified customer profiles and build audiences.

Diagram showing Segment as the central hub of a tech stack, connecting various data sources (e.g., apps, websites, servers) to multiple destinations (e.g., analytics, marketing, and data storage tools).

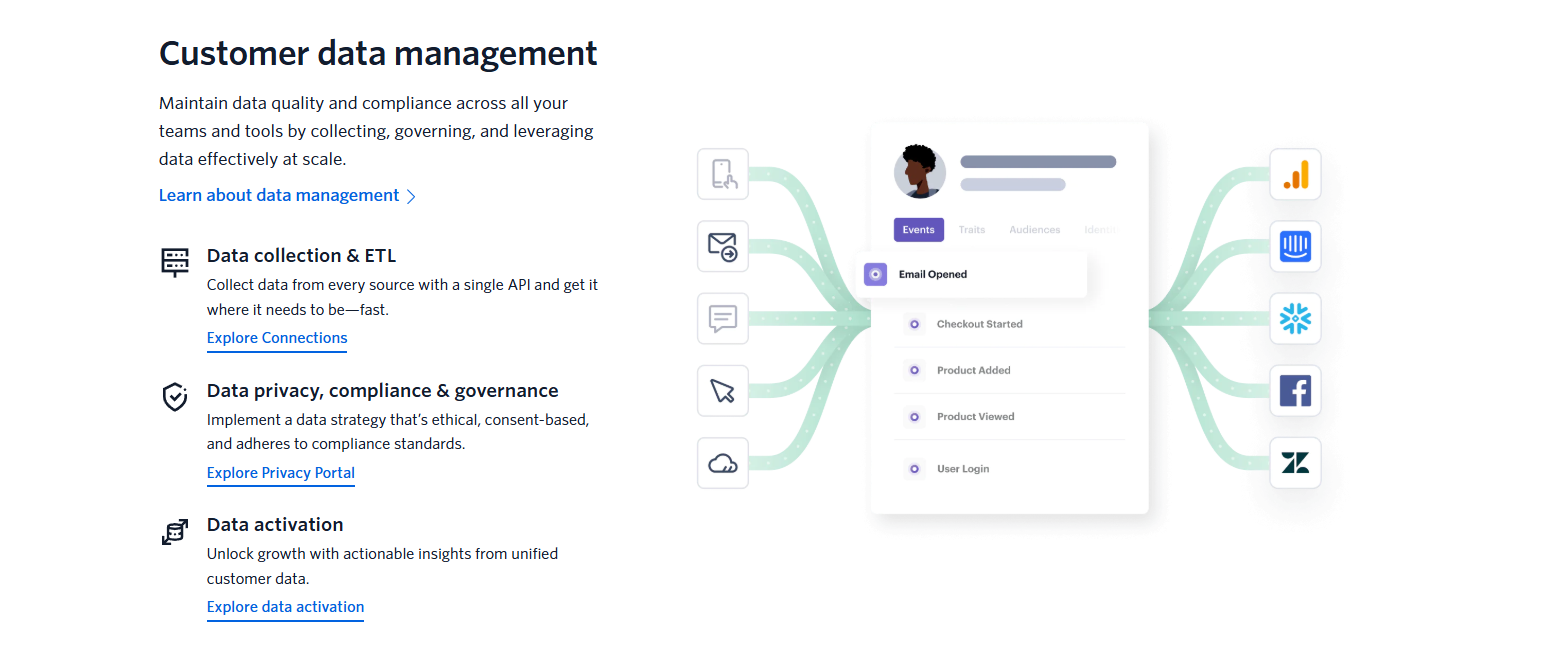

Hightouch tackled the problem from the opposite direction, assuming companies already had their customer data neatly organized in a data warehouse like Snowflake or BigQuery. Its focus wasn’t on collecting new data, but on making it easy to take the valuable, organized data you already have out of the warehouse and send it to your marketing and sales tools. This process is often called Reverse ETL. Hightouch has also expanded to handle real-time data streams and offer AI-powered features.

Hightouch’s Customer Studio interface displaying the Audience view, featuring filters and insights on high-LTV users who abandoned email campaigns.

Think of it like building with Lego. Segment initially focused on providing the bricks (collecting the event data) and letting you send them wherever needed. Hightouch focused on assuming you already had organized boxes of bricks (your data warehouse) and specialized in building specific things from those boxes (activating the data via R-ETL).

Segment vs. Hightouch: Key Differences You Need to Know

This section breaks down how Segment and Hightouch differ across architecture, pricing, ease of use, and activation capabilities. While Segment and Hightouch initially had distinct starting points, the lines have blurred. Segment added robust Reverse ETL features, and Hightouch added real-time event streaming (Hightouch Events). Both now offer overlapping capabilities, making the choice more nuanced.

Choosing between them isn’t straightforward. Both are powerful platforms, but they retain different core philosophies, strengths, and weaknesses, which are reflected in their architecture, features, and pricing. This post aims to cut through the noise, comparing Segment and Hightouch directly to help you understand which platform is the better fit for your specific needs, team structure, data maturity, and budget as of September 2025. We’ll explore their core functionalities, pricing models, ease of use, and key features to guide your decision.

Segment vs. Hightouch Feature Comparison Table

For those looking for a quick overview, here’s how the two platforms stack up:

| Feature/Aspect | Segment | Hightouch |

| Core Philosophy | Hybrid: Event Collection First (CDP) + Data Warehouse Activation | Data Warehouse Activation First (Reverse ETL) + AI Decisioning |

| Primary Data Source | SDKs, Event Sources, Cloud Apps, Warehouse | Data Warehouse (Primary), Event Streams (Add-on) |

| Ease of Use / Team Focus | Faster setup for common marketing cases; Intuitive UI for Ops/Product; automated deployment options | Deeper control favored by Data teams; Steeper learning curve requiring SQL/warehouse skills |

| Pricing Model | Primarily MTU-based + Feature Add-ons (Unify/Engage) | Multi-variable: Sync-based + Features + Optional Events (MTU/Event) |

| Reverse ETL (R-ETL) | Included; Generous row allowances; Cost-effective; Less configurable | Core Feature; Highly Robust & Configurable; Potentially higher cost depending on usage |

| Event Collection | Core Strength; Wide Source Support; Includes Tag Management | Add-on Feature (Hightouch Events); Very limited; requires custom development; Only supports 12 destinations; No Tag Management |

| Key Differentiators | Broad Integration Catalog, Unify, Tag Management, Cloud Object ETL, Marketer-friendly interface, API-based Workspace Management & Terraform Provider | AI Decisioning, MatchBoost, Broader DB Source Support, Specific Integrations |

| Ideal User Profile | Marketing/Product-led teams; Emphasis on real-time event collection; Greenfield collection implementations | Data-mature teams; Warehouse-centric stack; Need for granular R-ETL control/advanced features |

| Custom Object Handling | Add-on (Linked Audiences/Events); Less mature | Included (Models); More Mature & Flexible |

Deep Dive: Segment (The Event-Driven CDP)

Segment established itself by simplifying the collection of customer event data via a single API and routing it effectively while being a fully fledged CDP that supports identity resolution and data activation.

Segment Strengths:

- User Experience & Implementation: Offers a generally faster onboarding for common marketing use cases (event collection, basic audience building). The UI is often considered intuitive for Marketing Ops or Product Managers, reducing initial dependency on dedicated data engineers for standard configurations.

- Event-First Focus: Core strength in event collection simplifies tracking user behavior across digital properties. Its Connections product is mature and robust.

- Integrated Database: Segment can host your 360° customer view within its own database through Unify. This can be easier to manage than having to build your own data infrastructure for your CDP data, and eliminates the need for complex data prep when you use Segment’s built-in data sources.

- Pricing Model & Predictability: Primarily uses Monthly Tracked Users (MTUs). This model is relatively straightforward to forecast based on user activity. Adding more destinations generally doesn’t directly increase MTU-based cost. R-ETL usage often falls within generous plan allowances based on synced rows (typically counting only changed data after initial sync), making frequent syncs cost-effective from a platform perspective.

- Broad Ecosystem & Integrated Features: Boasts one of the largest catalogs of pre-built Sources and Destinations. Can function as a client-side tag manager, potentially reducing reliance on tools like GTM. Supports ingesting some non-event data (e.g., ad spend) into warehouses via “Cloud Object Sources”, potentially reducing the need for separate ETL tools.

- Simple and Real-time Identity Resolution + Computed Traits: Segment Unify provides a relatively straightforward way to stitch user identities based on defined hierarchies without complex warehouse modeling. Because Segment ingests data from all sources and doesn’t rely on a pure zero-copy architecture, it handles real-time use cases particularly well.

- Accessible Audience Builder + AI Audiences and Traits: Segment Engage offers a user-friendly interface for audience creation and activation, often usable by marketing teams directly. Moreover, Segment does offer out-of-the-box AI predictive audiences and traits.

- Zero-copy Architecture: Linked Audiences and Reverse ETL utilize zero-copy architecture.

- Easy Backfill of Historical Data into New Destinations: Segment allows customers to replay historical data into new destinations. This enables backfilling new analytics destinations with years of historical data.

- Powerful Management APIs and Infrastructure as Code: Segment supports enterprise-scale automation through its Public API, Terraform provider, and Git-based change management, which lets teams define sources, destinations, tracking plans, and permissions as code. This enables organizations to stamp out consistent, governed configurations across multiple brands, regions, or environments. For companies with multi-tenant or multi-brand requirements, it provides a scalable, repeatable way to manage complex data pipelines with auditability and version control built in.

- All-Inclusive Pricing on Compute Costs: With Segment ingesting and storing event data, compute and storage costs are minimal or non-existent if not syncing data to or from data warehouses.

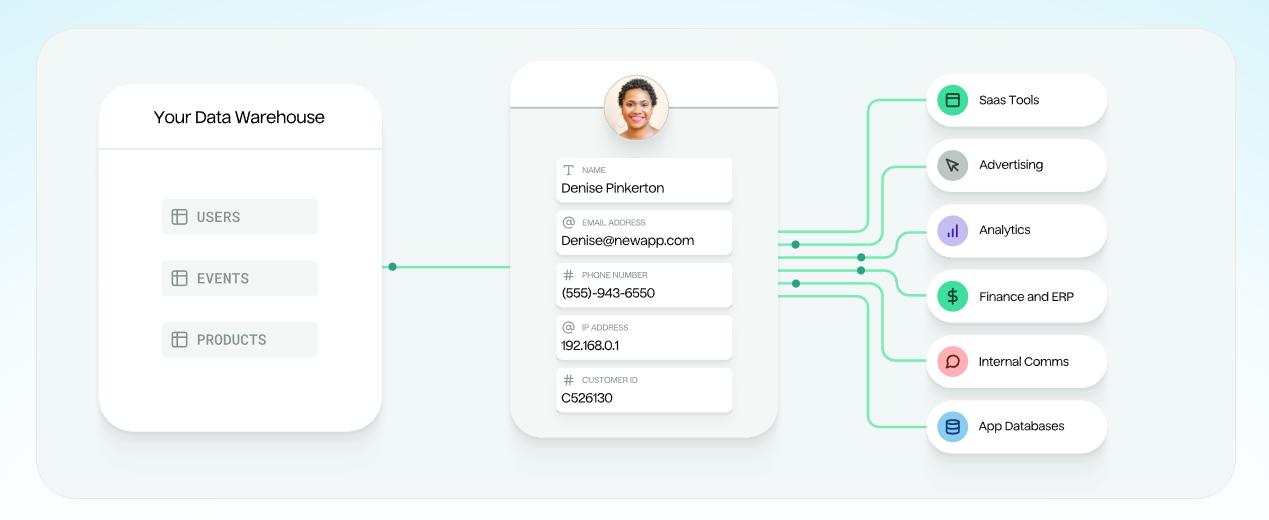

Diagram illustrating a customer at the center, connected to multiple data sources (e.g., websites, apps, servers) for data collection and ETL. The diagram highlights key aspects of customer data management.

Segment Weaknesses:

- Cost Variability Risk (MTU): While predictable day-to-day, the MTU model carries the risk of significant cost increases from variable traffic or unexpected spikes (sales, bots). Overage charges or paying for unused capacity are potential issues.

- Simpler R-ETL Capabilities: While cost-effective, Segment’s R-ETL is less configurable and feature-rich than Hightouch’s. It lacks advanced modeling integrations (like direct Looker sync) and developer features (like Git sync). May feel limiting for complex, warehouse-native activation needs.

- Less Mature Custom Object Handling: Linked Audiences/Events for leveraging warehouse objects is functional but less flexible, less mature, and an extra cost compared to Hightouch’s core Models.

- Simpler Feature Set & Configuration: Less depth in areas like journey building logic (lacks AI) and highly custom R-ETL modeling compared to Hightouch.

- Lacks Certain Advanced Activation Features: No direct equivalents to Hightouch’s AI Decisioning and no equivalent to MatchBoost.

- Not Fully Zero-copy: Segment’s zero-copy capabilities are limited to Linked Audiences and Reverse ETL. Features like identity resolution, Unify, and Engage require and benefit from Segment’s internal database.

Deep Dive: Hightouch (The Warehouse Activation Platform)

Hightouch emerged with a warehouse-first philosophy, excelling at activating curated data from existing cloud data warehouses.

Hightouch Strengths:

- Robust Reverse ETL (R-ETL): This is Hightouch’s core competency. Offers highly configurable syncs, flexible scheduling, advanced error handling, and features tailored for data teams. Ideal when the warehouse is the source of truth.

- Zero-copy data architecture: Hightouch offers zero-copy data architecture which in simple terms means that data stays inside of your data warehouse and isn’t stored by Hightouch. For sensitive data, such as protected health information under HIPAA, this has compliance and information security advantages.

- Advanced Modeling & Custom Objects: The Models feature (included in all plans) provides powerful and flexible ways (SQL, dbt, Looker, Sheets, UI) to define data for syncing, handling custom objects effectively.

- Developer-Focused Features: Capabilities like Git Sync offer version control/governance. MatchBoost aids enrichment. Orchestration features coordinate pipelines. Favored by data teams needing granular control.

- Advanced & Unique Activation Capabilities: Offers AI Decisioning for ML-driven journey optimization. MatchBoost provides warehouse-based identity onboarding. These are significant differentiators for specific use cases.

- Integration Specificity & Database Support: While Segment has more destinations overall, Hightouch offers key integrations Segment lacks and excels at connecting to a wider variety of database sources (SQL/NoSQL).

- Potential Cost-Effectiveness (Specific Scenarios): For organizations focused solely on warehouse activation with predictable, controlled sync patterns (low frequency/volume), the sync-based model can be more cost-effective than a high-MTU Segment plan.

Hightouch diagram depicting a customer at the center, with a data warehouse aggregating information and feeding it into various destinations, including advertising platforms, analytics tools, and other business applications.

Hightouch Weaknesses:

- Pricing Model Complexity & Potential Costs: Multi-variable pricing (syncs, destinations, features, optional events) makes forecasting harder. Costs can escalate significantly with more syncs or numerous destinations, requiring careful modeling and potentially outweighing Segment’s costs in such scenarios. In addition, if you’re using Hightouch’s real-time events, MTUs are added back as a variable in the comparison. Warehouse compute costs from frequent queries are also a factor (as with Segment R-ETL).

- Learning Curve & Resource Needs: Assumes higher data maturity and requires comfort with SQL/warehouse concepts. Presents a steeper learning curve for non-data teams. Requires dedicated data engineering resources for optimal setup and management.

- Event Collection is Secondary: Real-time event collection is an add-on, not core to the base offering, has fewer sources/features than Segment, and all require custom code or warehouse integration. Only supports a dozen destinations for real-time events streaming.

- Lacks Integrated Tag Management: Requires a separate tool (like GTM) for client-side tag deployment.

Head-to-Head Comparison: Making the Choice

Let’s directly compare key areas:

- Core Philosophy & Approach:

- Segment: Event-first hybrid CDP. Excels at collecting and routing behavioral data and storing it on their own infrastructure to power real-time audiences and traits. Has some zero and low copy data infrastructure but not part of the core product.

- Hightouch: Warehouse-first. Excels at activating curated data already in the warehouse while keeping all data off their infrastructure with zero-copy architecture. Handles complex models beyond users and events in all plans. Choose based on your primary data gravity and objective.

- Pricing Model & Cost Considerations:

- Segment: Primarily MTU-based. Relatively predictable but risk of spike-driven overages. R-ETL is often cost-effective within allowances. Good if event volume is stable and many destinations used.

- Hightouch: Multi-factor (syncs, destinations, features, events). Harder to forecast. Can be cheaper for warehouse-only, low-sync scenarios. Can get expensive with high sync frequency/volume. Evaluate specific usage patterns carefully against both models.

- Reverse ETL (R-ETL) Capabilities:

- Segment: Functional, integrated, often cost-effective R-ETL suitable for standard activation needs where extreme configuration isn’t primary.

- Hightouch: Best-in-class, highly configurable R-ETL. Ideal for complex, warehouse-native activation requiring granular control, advanced modeling, and developer tooling, albeit with associated resource needs and potential platform cost.

- Ease of Use & Team Alignment:

- Segment: Faster time-to-value for event collection/basic activation. More accessible for Marketing Ops/Product teams to manage day-to-day with less initial data engineering lift if not using R-ETL integration. Extensive management API, Git and DBT sync, and Terraform support for flexible and automated deployment.

- Hightouch: Requires greater data maturity and technical expertise. Longer time-to-value if warehouse/models need significant work. Supports Git sync for versioning, but has comparatively limited management APIs.

- Integrations (Sources & Destinations):

- Segment: Supports hundreds of data sources, including robust APIs for custom integrations. Has equally broad destination catalog, including many which are unsupported by Hightouch. Includes Tag Management.

- Hightouch: All sources require custom integration, either via code or through a data warehouse. Deeper database source support. Supports a wide range of destinations, although significantly fewer than Segment. (Although it does support a few which Segment lacks.)

- Advanced Features & Differentiation:

- Segment: Strengths in broad ecosystem, tag management, ETL capabilities. Less advanced in predictive/AI activation.

- Hightouch: Differentiates with AI Decisioning, and MatchBoost. Choose if these specific advanced activation or governance features are critical.

- Data Modeling / Custom Objects:

- Segment: Linked Audiences and Linked Events are functional add-ons. They are less flexible compared to Hightouch’s Models

- Hightouch: Models are core, more mature, and highly flexible for leveraging warehouse structures.

When to Choose Segment vs. Hightouch: Scenario Guide

Below are common real-world scenarios to help you decide whether Segment or Hightouch is the better fit based on data maturity, team structure, and activation needs.

This section answers the most common question teams ask:

Which platform fits my business model, data maturity, and activation needs?

In 2023, the decision of whether to choose Hightouch or Segment was a lot simpler: If you needed real-time event collection, you choose Segment. If your data was already in the data warehouse and you had data collection already in place, you choose Hightouch.

Since then, both companies have converged in terms of feature sets, with Hightouch introducing real-time event collection, and Segment introducing and improving its reverse ETL feature sets and introducing more zero-copy architecture through Linked Audiences.

So when it comes down to choosing Segment, let’s imagine a few scenarios.

Scenario 1: The Pure-Play Ecommerce Company

Best fit: Segment

Why?

- Real-Time Event Collection is the main goal: While both Segment and Hightouch have real-time events, if real-time event collection is the primary use case and there are limited data warehouse use cases, Segment is a better fit.

- Tag Management: Segment acts as a tag manager, simplifying the deployment of Meta pixels, Google Ads tags, and other client-side scripts crucial for e-commerce advertising.

- Marketing Team Empowerment: The marketing team can directly implement and manage event tracking for campaigns using Segment’s intuitive UI, without needing to file tickets with engineering for every change.

- Lower Initial Complexity: For a business focused on the digital journey, Segment provides the most direct path to value. It avoids the need to build, populate, and maintain complex data warehouse models just to power core marketing automation. The focus is on activating the live event stream including with client-side tagging ingesting events.

An online-only retailer (e.g., fashion, electronics) focused on driving sales through their website and app. Their primary needs are real-time personalization and marketing automation. They have a small data team and may not have a mature, centralized data warehouse.

Their key use cases are triggering abandoned cart emails, personalizing product recommendations on the website, reporting on marketing campaign performance, and retargeting users on ad platforms.

While Hightouch does have real-time event collection, Segment is much more developed in this regard and is a better fit for this particular scenario.

Scenario 2: The Security-Conscious Healthcare Company:

Best fit: Hightouch

Scenario 3: The Mature Omnichannel Retailer

Why: Segment or Hightouch

Why? This is where the two platforms’ strengths overlap and create a complex decision.

The Case for Segment: The retailer’s e-commerce operation needs best-in-class real-time event collection, which is Segment’s forte. Segment Unify could be crucial for merging anonymous website visitors with known customer profiles from their CRM.

The Case for Hightouch: The most valuable data for this retailer likely lives in their warehouse—in-store transactions, loyalty data, call center interactions, and supply chain information. Activating this rich, historical, and offline data is Hightouch’s core strength. Their complex business structure likely involves custom objects (e.g., store-level data, product hierarchies) that are better handled by Hightouch’s flexible Models than Segment’s Linked Audiences.

The Deciding Factor: The choice hinges on the retailer’s primary strategic goal. Is it to optimize the real-time digital experience above all else (leaning Segment)? Or is it to activate a unified, 360-degree view of the customer from the warehouse to power all channels (leaning Hightouch)? A head-to-head bake-off is the only way to be sure, testing which platform better handles their specific mix of real-time web data and complex, warehouse-native batch data.

Their key use cases are unifying online browsing behavior with in-store purchase history, personalizing marketing based on loyalty status, and enabling call center agents with a 360-degree customer view.

A large, established retailer with a thriving e-commerce site, a network of physical stores, and a customer service call center. They have a mature data team and a sophisticated data warehouse that ingests data from all parts of the business.

Conclusion: Navigating a Converging Market, Not Just Buzzwords

As you evaluate Segment and Hightouch, it’s easy to get caught in the crossfire of marketing terms like “composable CDP” and “warehouse-native.” The reality is that the lines between these platforms are blurring. Segment has deepened its warehouse integration, while Hightouch has added real-time event collection. The choice is less about rigid categories and more about understanding architectural philosophies and their practical trade-offs.

The composable, or warehouse-native, approach championed by Hightouch is powerful. It leverages your warehouse as the source of truth, which is ideal for governance and complex data models. However, it is not a panacea. A zero-copy architecture, which avoids storing data on the vendor’s platform, often translates to shifting costs, not eliminating them. Platform fees may be lower, but warehouse compute costs from frequent queries and the salaries of data engineers required to maintain the system can increase. For highly regulated industries like healthcare, this trade-off is often necessary for compliance. For others, a hybrid platform like Segment that manages its own optimized data store for high-volume events can be more cost-effective and efficient.

Finally, advanced features like Hightouch’s AI Decisioning or Segment’s AI Audiences are compelling, but they require the right data and a clear use case to provide value. You must assess if the data foundation and business strategy exist to make such features drive incremental results.

Ultimately, the decision rests on a clear-eyed assessment of organizational needs. The selection should not be based on the platform alone, but on the architectural philosophy that best aligns with the team’s skills, data maturity, and critical business goals.

Let McGaw Help You Decide

Selecting the right CDP is a major decision. It’s one that can significantly impact your data strategy and business outcomes. So, if you’re not sure which platform aligns best with your needs, we’re here to help. Our experts will help you assess your data requirements, budget constraints, and technical resources to identify the ideal CDP that maximizes your data operations and drives your business forward.

Contact McGaw today to discover the perfect CDP for your business and elevate your data strategy to the next level.

Frequently Asked Questions (FAQ)

Is Segment or Hightouch a better CDP?

Segment is a full CDP with event collection, identity, and activation. Hightouch is an activation layer that extends your warehouse and behaves like a CDP when paired with strong data modeling.

Is Segment or Hightouch better for real-time events?

Segment. It has more mature real-time pipelines and built-in tagging that supports client-side and server-side events out of the box.

Which tool is better if my warehouse already holds all my customer data?

Hightouch. It activates warehouse models directly, supports more complex transformations, and aligns with data engineering workflows.

Do both Segment and Hightouch offer reverse ETL?

Yes. Segment includes it as a built-in capability, but Hightouch provides more advanced configuration, scheduling, and governance for complex syncs.

Is Segment a CDP and Hightouch not?

Segment is a full CDP with event collection, identity stitching, audiences, and activation. Hightouch is an activation platform that can behave like parts of a CDP when paired with a warehouse, but does not replace a CDP’s native event ingestion or identity layer.

Which tool is easier for marketing teams to use?

Segment reduces engineering dependence, manages tagging, and provides unified profiles and audiences with minimal setup.

Hightouch though has a better UI and UX for marketing teams. While it may require some development stand up, it appears to be easier for marketers to use.

Is Hightouch better for personalization?

It’s better for warehouse-driven personalization, especially when models and segmentation are built in SQL. Segment is better for real-time, behavior-triggered personalization.

Can both tools work together?

Yes. Many companies use Segment for event collection and identity stitching, and Hightouch for warehouse activation and advanced R-ETL. This is a common “best of both worlds” architecture.

Fantastic Summary! Depth & clarity in brief – nicely done.

Thanks Shawn!

I enjoyed this article. Well done.